Nobody wants to deal with damage or loss during a move, but sometimes it happens. If you’re

not taking out additional insurance to protect your move, you could be missing out on the

peace of mind that comes with knowing your valuables are protected during your move should

a mishap happens.

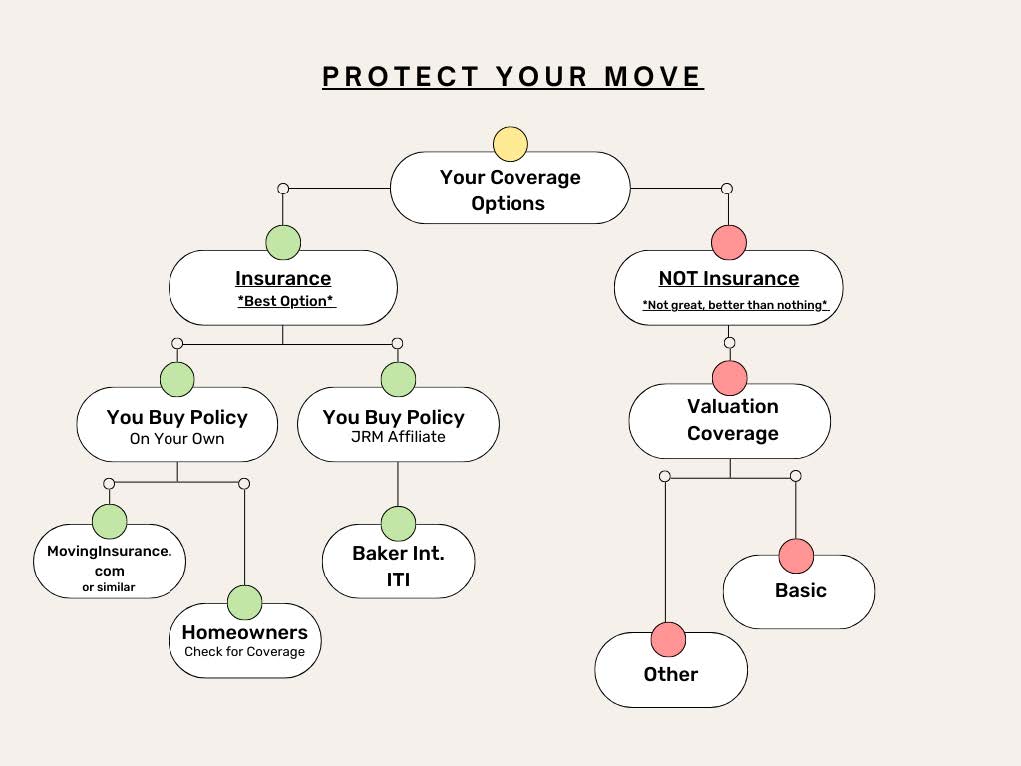

This blog post will help you understand the difference between valuation coverage and

moving insurance, why you want to purchase moving insurance, and the companies Jordan

River recommends buying a moving insurance policy.

What is Valuation Coverage

Basic Value Protection

Valuation coverage is NOT insurance. Basic valuation coverage is the limited liability a

moving company assumes when moving your things. It is the minimum amount of protection a

moving company or carrier must provide customers. This coverage is free, and you get what

you pay for.

● Coverage is minimal and based on the weight of your items- not the value.

● In the event of a lost or damaged item, valuation coverage allows the moving company

to pay you 60 cents per pound per item to cover the value of your item. For example,

let’s say your $1,000 MacBook Air laptop gets damaged during a move. Since it weighs

an airy 2.8 pounds, you would receive about $1.68. Yikes!

● Valuation coverage excludes many situations (think hurricanes, floods, etc.)

● Valuation coverage also excludes items of “extraordinary value” (think antiques, fine

art, etc.) unless a special agreement is made.

● Valuation coverage is better than no coverage, but you can understand why you might

want additional protection.

“Full-Value” Protection

There is a reason for the quotes on “full-value.” If you purchase additional valuation coverage,

read the paperwork and understand what you’re buying. Additional valuation coverage

upgrade options are available for purchase through Jordan River Moving. For an additional

charge, you can purchase more protection. Ask your Relocation Specialist about increased

valuation options, the deductibles involved, and how they might apply to your situation. These

options are still NOT insurance; I think moving insurance gives you a better bang for your

buck.

What is Moving Insurance

Moving insurance is a policy that protects your items if they are lost or damaged during your

move. Insurance offers more comprehensive coverage than the valuation provided by moving

companies. You purchase the insurance through a third-party insurance company, not from the

moving company. You get an actual insurance policy on the value of your items, not the

weight. Imagine your diamond bracelet’s weight vs. its value. If it gets lost or damaged, you

want compensation for the value, not the weight! There are many different companies and

options for moving insurance, so you’ll need to research and choose the best company and

coverage for you.

Why You Want Moving Insurance

Moving insurance offers extra protection and peace of mind during a move. It doesn’t hurt to

have additional protection if something happens. There are different levels of coverage and

deductibles. Choose the right plan and breathe a sigh of relief, knowing you’re covered. I

strongly suggest moving insurance for these reasons:

● If you have expensive items (furniture, electronics, jewelry).

● If you have “irreplaceable” items such as antiques, fine art, or family heirlooms.

● If you’re moving long-distance, items have a higher chance of loss or damage based on

the distance they’re traveling.

● Insurance companies have adjusters that can more accurately determine the value of

your items if you need to file a claim.

● Insurance policies can pay out the full replacement value of your item.

● Insurance is purchased from a third party, not from the moving company.

● Policies are easy to buy online.

● Important note- you must purchase insurance at least 2 days before your move!

Recommended Companies for Moving Insurance

You can buy moving insurance from any company you want. Do your research and choose

what’s right for you. Jordan River Moving highly recommends the following companies for

moving insurance:

● MovingInsurance.com– you purchase online.

● Baker International Insurance Agency (your Relocation Specialist can help you).

● ITI- Inter Trans Insurance (your Relocation Specialist can help you).

● Check with your homeowners/ renter’s insurance companies before purchasing moving

insurance. You may already be covered. Make sure to check with your insurance agent.

Accidents Happen- Even with the Best Moving Companies

Jordan River Moving is a high-quality moving company that cares about transporting your

valuable items safely. The fact is, accidents can happen when moving. Movers are human.

Things can get damaged during transport. There are fires, floods, and natural disasters.

Mishaps happen, and it’s essential to understand the difference between valuation coverage

and moving insurance, the benefits of purchasing moving insurance, and some companies

recommended by Jordan River Moving.

If damage or loss occurs during your move and you didn’t purchase moving insurance, you can

file a valuation coverage claim with Jordan River Moving. They try to make the process as

easy as possible. Contact their office for more information.

Moving Insurance Resources:

MovingInsurance.com click here.

Baker International Insurance Agency click here.

ITI- Inter Trans Insurance click here.

For help purchasing moving insurance through ITI or Baker International, contact your

Relocation Specialist at Jordan River Moving or visit the Jordan River Moving site here.

For more information about protecting your move visit the Federal Motor Carrier Safety

Administration website here.